Property taxes are one of the maximum critical resources of revenue for local governments, and they may be amassed annually from owners and enterprise proprietors across the country. Assets taxes are used to fund crucial public offerings including colleges, police and fireplace protection, libraries, and roads. At the same time as the quantity of a assets tax invoice can range appreciably from one area to some other, all neighborhood governments use the identical primary ideas to calculate belongings taxes.

Knowledge the basics of assets Tax

Assets taxes are calculated at the assessed cost of a belongings. This value is determined by means of the neighborhood tax assessor, who takes under consideration factors inclusive of the dimensions of the property, the condition of the belongings, and the price of comparable homes within the location. The assessed value is normally lots lower than the real market value of the property, for the reason that local authorities does now not need to overtax its residents.

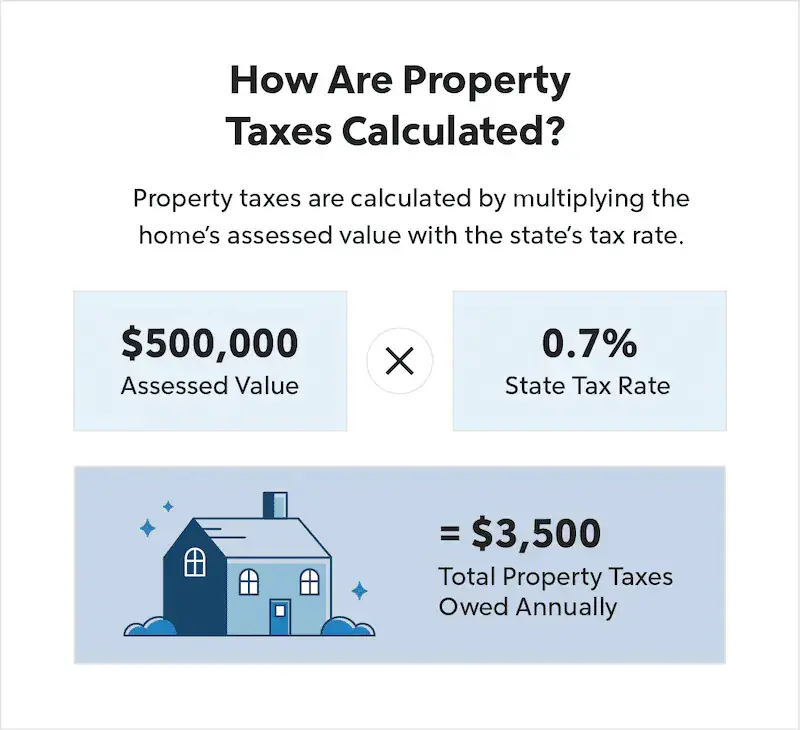

As soon as the belongings is classed, the nearby authorities multiplies the assessed value through the tax rate for the municipality. This rate is determined via the local authorities and might range from one vicinity to every other. The rate is generally expressed as a percentage, and it’s miles normally between 0.5% and 2% of the assessed value of the property.

Similarly to the property tax, maximum states and neighborhood governments additionally levy a supplemental tax on properties that have positive functions, including a swimming pool or a guest residence. This supplemental tax is calculated one at a time and added to the whole assets tax invoice. Calculating property Tax payments

As soon as the assessed value of the assets and the tax charge have been decided, it is simple to calculate the overall assets tax invoice. The formulation for calculating assets taxes is:

Property Tax Assessed fee Tax fee

As an instance, if a property is classed at $200,000 and the nearby tax rate is 1%, the belongings tax invoice might be $2,000 ($200,000 x zero.01).

In addition to calculating the whole property tax invoice, nearby governments additionally provide house owners and business owners with a breakdown of the way their taxes are allocated. This breakdown usually consists of the quantity of money this is allotted to the nearby school district, the quantity this is allotted to the metropolis or county authorities, and the amount that is allocated to big districts, together with fireplace safety or water districts.

Tax relief packages

If you want to help alleviate the burden of property taxes on house owners, many states and nearby governments offer tax comfort applications. Those packages provide belongings tax alleviation to qualifying house owners, normally in the form of a tax credit or a property tax discount.

As an example, in a few states, qualifying seniors may get hold of a belongings tax credit that offsets a portion of their belongings taxes. Different states offer assets tax remedy programs for veterans, disabled individuals, and families with low incomes.

Similarly to state and nearby tax alleviation programs, many counties and municipalities additionally offer their very own assets tax comfort packages. Those applications can include exemptions or deferrals for positive styles of property, together with agricultural land or ancient buildings.

The lowest Line

Property taxes are an vital source of revenue for nearby governments, and they’re calculated annually primarily based at the assessed cost of the belongings and the nearby tax rate. Assets taxes are usually calculated the use of the method: belongings Tax = Assessed value x Tax charge. Further to calculating the full assets tax bill, nearby governments additionally offer house owners and commercial enterprise owners with a breakdown of the way their taxes are allotted. To assist alleviate the weight of assets taxes, many states and neighborhood governments offer tax alleviation programs for qualifying individuals and households.