How Does Nav Affect Mutual Fund

The impact of NAV on Mutual Fund Returns: explained

NAV or net Asset fee is an essential term that every mutual fund investor have to apprehend. The NAV of a mutual fund is the rate at which investors purchase or sell units of the fund. It’s far calculated through dividing the whole price of the fund’s assets by the wide variety of units top notch. Many investors consider that better NAV manner higher returns, however is that really proper? On this put up, we will explore the effect of NAV on mutual fund returns and explain why it’s vital to don’t forget NAV when making investment choices. We will cowl the whole thing you want to recognise approximately NAV, how it influences mutual fund returns, and a way to use it on your advantage while making an investment in mutual budget. So, whether you’re a new investor or an experienced one, read directly to learn greater about the effect of NAV on mutual fund returns.

What is NAV in mutual budget?

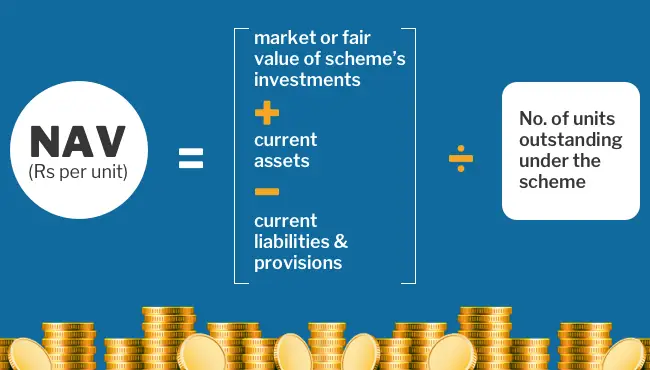

NAV stands for net Asset fee and it’s miles a vital time period in the international of mutual finances. In simple terms, NAV is the cutting-edge marketplace price of the belongings held by the mutual fund scheme minus its liabilities. This NAV value is calculated with the aid of dividing the entire internet property of the scheme with the aid of the wide variety of extraordinary gadgets.

The mutual fund NAV is calculated at the cease of each business day. It’s miles critical to note that the NAV of a mutual fund scheme is not consistent and can vary depending in the marketplace price of the underlying securities held through the scheme.

The NAV of a mutual fund scheme plays a enormous function in figuring out the returns generated via the scheme. The better the NAV, the better the returns, and vice versa. However, it is important to note that the NAV alone can’t be the sole parameter to judge the performance of a mutual fund scheme. Different factors including fund manager overall performance, funding strategy, and market conditions additionally play a crucial role in determining the returns generated through a mutual fund scheme.

As an investor, it’s far vital to understand the concept of NAV and its impact on mutual fund returns to make informed investment decisions. Understanding how NAV is calculated and the way it may vary can help traders in deciding on the proper mutual fund scheme primarily based on their investment desires and risk appetite.

How is NAV calculated?

Internet Asset fee (NAV) is a crucial aspect in determining the value of a mutual fund. NAV is calculated with the aid of dividing the full fee of the property held by means of the mutual fund by way of the entire range of units exceptional. The assets consist of stocks, bonds, and other securities held through the mutual fund. The price of these property is decided with the aid of their marketplace price at the give up of the buying and selling day.

The NAV of a mutual fund modifications each day because the cost of the underlying property changes. For instance, if the cost of the property held by means of the mutual fund increases, then the NAV of the fund will also growth. Further, if the fee of the belongings decreases, then the NAV of the fund will also decrease.

It’s vital to note that the NAV of a mutual fund does no longer replicate the overall performance of the mutual fund. Rather, it is a measure of the cost of the belongings held with the aid of the mutual fund at a particular point in time. The overall performance of a mutual fund is measured by the returns it generates over a sure period of time.

In conclusion, know-how how NAV is calculated is crucial for traders to make informed choices about their investments in mutual budget. It’s far a key element in figuring out the fee of a mutual fund and might have a big impact at the returns generated through the fund.

Why NAV topics for mutual fund returns?

NAV or net Asset fee is an critical element that influences mutual fund returns. It is the fee in keeping with unit of a mutual fund and is calculated by way of dividing the entire value of the property within the fund by means of the whole range of exceptional units.

A mutual fund’s overall performance can be decided by monitoring its NAV over time. Whilst the NAV of a mutual fund increases, it way that the value of the investments held via the fund has long past up, resulting in better returns for investors. However, when the NAV decreases, it suggests that the cost of the fund’s investments has declined, resulting in decrease returns for traders.

Considering that mutual fund returns are calculated based totally at the exchange in NAV over a period of time, it is important for buyers to recognize the effect of NAV on their investments. Traders should maintain tune of the NAV in their mutual fund investments regularly to gauge the performance in their investments.

Moreover, it’s far essential to notice that evaluating the NAV of two mutual budget isn’t a dependable way of determining which fund is acting better. This is because the NAV of a mutual fund is motivated with the aid of numerous elements consisting of the kind of investments held through the fund, the marketplace conditions, and the prices incurred via the fund. Therefore, investors should cognizance on the general performance of the mutual fund in place of simply its NAV.

The effect of NAV on mutual fund returns.

When investing in mutual finances, one of the key terms you’ll stumble upon is NAV or internet asset price. NAV is the overall fee of the fund’s property, which includes cash, minus any liabilities, divided by using the wide variety of outstanding shares. It’s basically the in step with-proportion value of the fund.

The NAV of a mutual fund is calculated at the cease of each buying and selling day and displays the adjustments inside the marketplace price of the underlying property. Which means the NAV of a mutual fund can vary from daily, depending at the performance of the securities held within the fund’s portfolio.

So, how does NAV impact mutual fund returns? The solution lies within the way mutual funds are sold and bought. Whilst you invest in a mutual fund, you buy shares on the NAV charge. Whilst you promote those shares, you’ll receive the NAV price at that point in time.

If the NAV of the mutual fund has multiplied at some stage in the time you held the shares, you’ll earn a profit for your funding. Alternatively, if the NAV has reduced, you’ll incur a loss. Which means the NAV performs a vital role in figuring out the returns generated by way of a mutual fund funding.

It’s crucial to notice that the NAV is just one issue that impacts mutual fund returns. Other factors inclusive of the expense ratio, the fund manager’s approach and know-how, and market situations additionally play a position. As an investor, it’s crucial to don’t forget these kinds of elements earlier than making funding choices.

A way to interpret NAV while investing in mutual funds?

NAV or net Asset cost is an essential metric to recollect while investing in mutual budget. It’s far the cost of the mutual fund’s property minus its liabilities. In easy phrases, it represents the rate in keeping with proportion of the mutual fund. The NAV of a mutual fund fluctuates day by day based at the overall performance of the underlying assets.

With regards to interpreting NAV, it’s far vital to remember that a excessive NAV does no longer always mean that a mutual fund is acting higher than one with a lower NAV. The overall performance of a mutual fund is higher judged with the aid of its returns over a particular length. It is important to research the fund’s past overall performance and compare it with its benchmark index earlier than you make a decision to invest.

Every other factor to recall is the cost ratio of the mutual fund. This is the rate charged by means of the fund house for dealing with the mutual fund. A higher cost ratio can reduce the general returns of the mutual fund. Therefore, it’s miles essential to pick out a mutual fund with a lower fee ratio.

It is also vital to don’t forget the funding objective and the hazard profile of the mutual fund earlier than making an investment. A mutual fund with a higher hazard profile can also have a better NAV and may offer higher returns, but it could not be suitable for all traders.

In end, NAV is an critical metric to keep in mind when investing in mutual funds, however it have to now not be the best thing to consider. It is crucial to investigate the mutual fund’s beyond overall performance, cost ratio, investment objective, and chance profile earlier than making an funding decision.

Significance of thinking about the rate ratio further to NAV.

While deciding on a mutual fund, maximum buyers generally tend to awareness totally on the net Asset price (NAV) without considering the price ratio. While NAV is an important thing, it’s equally vital to remember the rate ratio as nicely.

The price ratio represents the charges charged by means of the mutual fund corporation for dealing with the fund. These costs can include administrative expenses, control prices, and other prices related to going for walks the fund.

It’s critical to word that the price ratio is deducted from the fund’s returns, which means the higher the price ratio, the decrease the returns may be for investors.

Before investing in a mutual fund, buyers need to evaluate the fee ratio to make certain it’s reasonable and competitive with different comparable funds. It’s additionally critical to remember the rate ratio in relation to the returns generated via the fund.

As an example, if two finances have comparable returns and one has a better cost ratio, it can be greater useful to choose the fund with the lower price ratio to maximize returns for buyers.

Typical, at the same time as NAV is an crucial element whilst deciding on a mutual fund, buyers must additionally don’t forget the price ratio to ensure they’re making informed investment decisions and maximizing their returns.

How to use NAV for comparing mutual fund overall performance.

NAV or net Asset value is a critical aspect in evaluating the overall performance of a mutual fund. It represents the cutting-edge market fee of the mutual fund’s property minus liabilities, divided by means of the range of superb devices.

To apply NAV for evaluating mutual fund overall performance, you ought to tune its movement over a time period. A rising NAV shows that the mutual fund’s property are acting properly, and vice versa. However, you need to additionally keep in mind other elements consisting of the fund’s funding targets, the fund manager’s music document, and the overall monetary climate.

One manner to use NAV for comparing mutual fund performance is to evaluate it towards a benchmark index. For instance, in case you’re investing in a huge-cap fund, you could compare its NAV increase against that of the BSE Sensex or Nifty 50. If the fund’s NAV increase outperforms the benchmark index, it shows that the fund is performing properly.

Every other manner to use NAV for evaluating mutual fund performance is to calculate the fund’s absolute returns. Absolute returns show the whole percent return generated by using the fund over a period of time. You may calculate absolute returns by way of subtracting the initial NAV from the final NAV, dividing it by means of the initial NAV, and multiplying the end result by means of 100.

In end, NAV is a key metric to assess mutual fund performance. But, it ought to be used along side different elements to make informed funding selections.

NAV and mutual fund investment strategies.

Investing in mutual budget is a popular manner to obtain investment goals, and know-how the internet Asset value (NAV) is vital to creating informed funding decisions. On account that NAV is a degree of a mutual fund’s standard overall performance, investors can use it to tune the fund’s development and compare it to different budget. But, NAV is simply one element of a mutual fund investment approach.

Traders want to understand of their funding goals, hazard tolerance, and investment horizon while developing a mutual fund investment strategy. As an example, making an investment in a low NAV mutual fund may appear to be a good concept, however it may not be relevant for an investor who’s seeking out long-time period profits. In addition, investing in a excessive NAV mutual fund may additionally look like a bad concept, but it could be relevant for an investor who is searching out quick-term gains or who has a excessive threat tolerance.

Traders must also do not forget the cost ratio of a mutual fund, that is the cost of owning the fund. A higher fee ratio approach less of the fund’s returns will visit the investor. It’s crucial to examine price ratios across price range to locate the first-class alternative.

In the end, NAV is just one factor to take into account whilst investing in mutual price range. Buyers have to create a method that aligns with their investment dreams, threat tolerance, and funding horizon, and they need to screen their budget’ performance regularly. With the aid of doing so, investors can make informed decisions and maximize their returns.

Tips for investing in mutual price range with a focal point on NAV.

When making an investment in mutual finances, know-how NAV (internet Asset cost) is important. NAV represents the entire fee of all the assets held by way of the fund minus any liabilities, divided with the aid of the whole quantity of stocks superb. In simple phrases, NAV is the rate according to proportion of the mutual fund, and it adjustments each day based at the overall performance of the underlying assets.

Here are some pointers for making an investment in mutual price range with a focal point on NAV:

Observe the NAV fashion over the long time, no longer just day-to-day fluctuations. A consistent boom in NAV shows a wholesome and well-controlled fund.

Evaluate the NAV of various finances in the equal class to become aware of those with the first-class overall performance.

Hold a watch at the rate ratio of the fund, which is the yearly price charged by way of the fund business enterprise for handling your cash. A high price ratio can eat into your returns, so it’s important to find a fund with a low cost ratio.

Diversify your portfolio via making an investment in funds with distinct NAV values and across extraordinary classes. This will help mitigate hazard and maximize returns.

Bear in mind, investing in mutual price range constantly includes a few degree of hazard, and NAV is simply one component to do not forget. It’s vital to do your studies, discuss with a economic guide, and make investments wisely to reap your financial dreams.

End and final thoughts.

In end, NAV is an critical element to recall while making an investment in mutual funds. The internet Asset fee of a mutual fund impacts the return on investment, and it’s essential to understand the way it works and a way to calculate it.

Buyers have to understand that NAV does now not determine the fine of a mutual fund. As an alternative, they ought to focus on different factors along with the cost ratio, funding method, and fund manager’s overall performance to decide whether or not a mutual fund is a superb investment.

It’s essential to behavior thorough studies and visit a monetary consultant earlier than investing in mutual funds. With the right knowledge and steerage, buyers can make informed decisions and acquire their monetary desires.

Universal, information the impact of NAV on mutual fund returns can help traders make higher funding choices and maximize their returns. Continually take into account that investing consists of risks, and it’s critical to diversify your portfolio and make investments for the long time.

We hope that this put up has helped you apprehend the effect of NAV on mutual fund returns. As an investor, it’s far critical to recognize the numerous components of mutual fund returns, and NAV is an vital one. With the aid of considering the factors that affect NAV and retaining a near watch on it, you can make informed investment selections that will help you attain your financial desires. We are hoping you found this information helpful and that it’ll help you make smarter funding decisions in the destiny.