What does fixed Income Mean in Investing

Demystifying constant income: A newbie’s guide to investing

Making an investment can be a frightening prospect, particularly if you’re new to it. There are such a lot of extraordinary kinds of investments to pick out from, and every comes with its personal set of risks and rewards. Constant income investments, such as bonds, are regularly encouraged for novices as they’re commonly taken into consideration to be more strong than other types of investments. However, constant earnings making an investment can be complicated in case you don’t recognise where to begin. In this submit, we will demystify fixed profits investing and give you a novice’s manual to investing in bonds. We’ll give an explanation for what fixed profits is, the way it works, how to compare bonds, and more. By the quit of this put up, you’ll have a strong knowledge of constant earnings making an investment and be equipped to take the first step closer to building your funding portfolio.

What is Fixed Income?

Fixed profits is an investment elegance that refers to any sort of funding that pays a hard and fast return on a regular basis. Constant income investments are also called constant-interest securities or bonds and are a famous investment desire for those seeking a regular circulation of earnings and a lower stage of risk.

Fixed earnings is a form of debt safety where the borrower problems a bond or word to an investor. The borrower then pays the investor a fixed hobby price over a fixed time frame till the bond or be aware reaches its maturity date.

Buyers can purchase fixed earnings securities from governments, companies, municipalities, and different entities that need to elevate money. The cash raised from the sale of those securities is then used to fund numerous initiatives, operations, and charges.

The hobby fee paid to the investor is determined by various factors such as the creditworthiness of the issuer, the length of the funding term, and the triumphing interest costs in the marketplace.

Fixed earnings investments generally have a lower degree of threat than other varieties of investments which includes stocks and mutual funds, making them an attractive option for folks who fee balance and predictability in their investment portfolio. But, it’s critical to be aware that all investments deliver some degree of hazard and it’s essential to do your due diligence before making any funding choices.

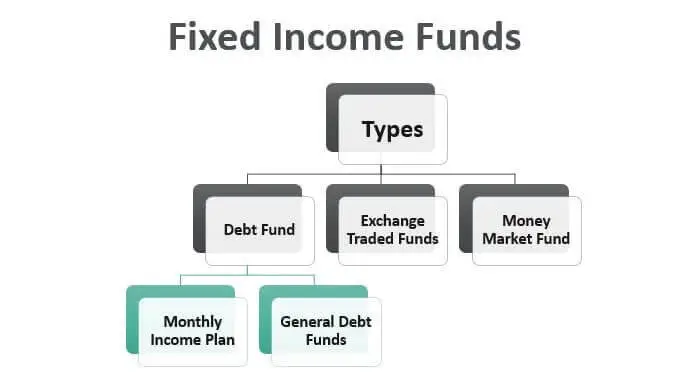

Varieties of fixed profits investments

Constant earnings investments offer a consistent flow of earnings, which is why they may be a famous desire amongst buyers. They’re generally considered a low-threat investment due to the fact they are subsidized by the company’s capacity to pay interest and main at the investment. There are several varieties of fixed profits investments that traders can choose from primarily based on their investment desires, danger tolerance, and investment horizon.

- Bonds: Bonds are a kind of debt security this is issued via groups, municipalities, and governments. They are normally labeled as either funding-grade or excessive-yield bonds, depending on the creditworthiness of the provider. Investment-grade bonds are issued by using organizations or governments with a high credit score and are taken into consideration much less unstable than high-yield bonds.

- Treasury securities: those are issued through the U.S. Treasury department and are subsidized by using the entire religion and credit score of the U.S. Government. They include Treasury payments, Treasury notes, and Treasury bonds.

- Municipal bonds: Municipal bonds are issued by means of country and neighborhood governments to finance public projects including schools, highways, and hospitals. They may be commonly exempt from federal profits tax and can also be exempt from kingdom and local taxes.

- Certificates of deposit: A certificate of deposit (CD) is a time deposit that pays a fixed fee of interest for a particular term, starting from some months to several years.

- Favored stock: desired inventory is a sort of stock that will pay a set dividend and is taken into consideration less unstable than common stock.

Buyers should carefully bear in mind every sort of constant earnings investment and their man or woman characteristics before making an investment their hard-earned cash. By way of understanding the special sorts of constant income investments, investors can make informed choices and create a diversified investment portfolio.

Blessings of making an investment in constant income

Investing in constant profits can offer many advantages to new buyers. One predominant advantage is the steadiness and predictability of returns. Fixed profits investments commonly provide a steady circulation of income, making them a famous choice for retirement making plans or for those in search of a dependable source of passive earnings.

Some other gain of constant earnings investing is the capability for capital renovation. Not like stocks, constant earnings securities are usually considered to be much less volatile and feature a decrease danger of dropping price. This makes them a fantastic choice for the ones seeking to hold their wealth over the long term.

Moreover, fixed profits investments can offer diversification to a portfolio. By way of investing in a mixture of asset instructions, along with constant earnings securities, traders can unfold their hazard and probably reduce the effect of market fluctuations on their universal portfolio.

Ultimately, fixed profits investments may also provide tax benefits. Relying on the type of funding and the investor’s person tax state of affairs, constant earnings securities can be situation to lower tax rates or can be exempt from certain taxes altogether.

Standard, constant earnings investments can offer various advantages to new traders, including stability, predictability, diversification, and ability tax blessings. It’s essential to remember those elements while identifying whether or not constant profits is the proper desire for your funding method.

Risks of investing in fixed earnings

Investing in constant earnings can offer a constant movement of earnings, but like every funding, it comes with its very own set of dangers. The maximum obvious threat is the opportunity of dropping cash if the borrower defaults on their loan. This is referred to as credit score danger and is specially relevant for high-yield bonds. Those bonds are issued via businesses that have a better hazard of defaulting, and consequently, provide higher returns to compensate traders for this risk.

Inflation danger is any other critical consideration. Constant earnings securities are normally issued with a hard and fast hobby fee, because of this that if inflation rises, the buying power of the interest payments decreases. This may erode the price of the investment and reduce the actual price of return.

There’s also hobby fee threat to don’t forget. As interest prices upward thrust, the value of fixed earnings securities decreases. That is due to the fact more moderen bonds will offer higher returns, making older bonds less appealing to traders. Conversely, if hobby rates fall, the value of existing bonds will boom, making them extra precious to buyers.

Ultimately, there is liquidity chance. Fixed profits securities are not as without problems traded as shares and may take longer to promote. This can be intricate if an investor desires to promote speedy because of surprising expenses or modifications within the marketplace.

Traders should cautiously recall those risks earlier than making an investment in constant income securities and visit a economic consultant to decide the suitable investment method for their desires.

How to determine if fixed profits is proper for you

Fixed income investments, consisting of bonds, can be a terrific manner to diversify your portfolio and offer a regular movement of earnings. But, they are not proper for everybody. It’s crucial to apprehend your economic dreams and your danger tolerance before finding out if fixed income is proper for you.

In case you’re searching out a low-danger investment with a predictable return, fixed income can be a very good choice. These investments generally provide lower returns than equities, but in addition they carry plenty less hazard. If you’re nearing retirement or have a shorter funding horizon, constant earnings may also be a great preference as it offers a dependable stream of earnings.

Alternatively, in case you’re searching out better returns and are at ease with extra danger, equities can be a higher alternative. Additionally, if you have an extended funding horizon, you may have time to get over any market downturns and might have enough money to tackle extra risk.

It’s additionally vital to consider your average investment portfolio. Fixed earnings investments can be a exceptional way to diversify your portfolio, however in case you already have a variety of constant income investments, adding extra won’t provide a good deal gain. Make certain to don’t forget your entire funding portfolio before making any selections.

In the end, the decision to spend money on fixed profits must be based on your financial goals and chance tolerance. If you’re unsure, don’t forget speakme with a financial consultant who permit you to make an knowledgeable choice.

How to buy fixed earnings investments

Buying constant income investments is surprisingly straightforward, but it’s vital to apprehend the alternatives available to you. Firstly, you could purchase person bonds or bond finances. Character bonds have a set adulthood date and pay a fixed interest price over the existence of the bond. Bond budget, on the other hand, hold a portfolio of bonds and pay a variable hobby price that is determined by the underlying bonds inside the fund.

While shopping for character bonds, you’ll need to take into account the credit score excellent of the bond company, the adulthood date, and the hobby fee. You could buy bonds immediately from a broker or financial organization, or you can buy them via a bond fund.

Bond funds are a famous desire for traders who need to diversify their constant earnings investments. They provide publicity to an expansion of bonds and may be more without problems traded than man or woman bonds. However, they do come with control expenses that may devour into your returns.

Another alternative for purchasing fixed profits investments is through alternate-traded budget (ETFs). ETFs integrate the diversification advantages of bond price range with the tradability of character bonds. They are traded on an exchange like stocks and are clean to shop for and sell.

It’s crucial to understand the dangers associated with fixed profits investments, which includes hobby price danger and credit score chance. It’s additionally vital to don’t forget your investment dreams and danger tolerance while determining which fixed profits investments to shop for. Consulting with a economic guide assist you to make informed selections and build a various fixed income portfolio.

Know-how bond scores

While investing in fixed profits, know-how bond rankings is vital. Bond scores are classifications assigned to a bond via credit rating groups inclusive of Moody’s, general & terrible’s, and Fitch to evaluate the bond’s creditworthiness and the issuer’s potential to pay lower back the debt.

Bond rankings range from AAA, that’s the highest score, to D, which is the bottom score and suggests a bond in default.

Investors ought to pay close interest to bond scores because they offer perception into the danger associated with a specific bond. Bonds with higher scores are taken into consideration less unstable, however in addition they tend to offer decrease yields. Then again, bonds with lower scores are taken into consideration more risky but offer higher yields to compensate for the brought danger.

It’s crucial to notice that bond ratings aren’t the handiest issue to don’t forget when investing in constant income. Different factors which include the bond’s maturity, interest rate, and the company’s monetary health have to additionally be taken under consideration whilst making investment choices.

By using expertise bond ratings, traders could make informed choices when deciding on bonds that align with their chance tolerance and funding desires.

Yield to maturity vs. Yield to name

When you spend money on bonds, two regularly used phrases that you may come across are yield to maturity (YTM) and yield to name (YTC). Those two phrases are crucial due to the fact they inform you the price of return you could expect to receive from your bond funding.

YTM is the whole go back predicted on a bond if the bond is held until its adulthood date. In different phrases, it’s miles the annual return an investor can assume to acquire if the bond is held until its adulthood and all hobby bills are made on time. YTM assumes that the investor will maintain the bond until it matures.

On the other hand, YTC is the anticipated rate of go back of a bond so one can be called before its maturity date. In other phrases, the yield to call tells you the fee of return you can count on if the bond is referred to as at a particular charge before its maturity date. YTC is calculated within the identical way as YTM, however it assumes that the bond might be known as on the earliest feasible date.

It’s critical to word that YTC isn’t assured because the issuer of the bond has the proper, however now not the responsibility, to name the bond. In comparison, YTM is guaranteed so long as the bond is held till its adulthood date and all hobby payments are made on time.

Expertise the distinction between YTM and YTC is vital as it will let you make informed investment decisions while you invest in bonds.

The impact of hobby fees

Hobby costs play a essential function within the world of fixed earnings investing. They have got a right away impact at the price of bonds and the yield that investors can anticipate to obtain.

While hobby charges upward push, bond expenses fall. That is due to the fact newer bonds are issued with higher yields to draw traders, making present bonds with lower yields less appealing. As a end result, the rate of the present bonds must fall with the intention to increase their yield and lead them to competitive with the more recent bonds.

Conversely, whilst interest fees fall, bond fees upward push. This is due to the fact bonds with better yields become extra precious in a low fee surroundings, leading to an growth in fee.

It’s far critical for constant earnings investors to hold a close eye on interest rate moves and their capability effect on their portfolio. Adjustments in interest charges will have substantial implications on the overall performance of your investments and can affect the overall price of your portfolio.

Consequently, it’s miles critical to have a clear knowledge of the interest price surroundings and to adjust your portfolio accordingly to ensure that you are properly-located to capitalize on any possibilities that could rise up.

Techniques for making an investment in constant profits

Making an investment in constant profits can be a top notch manner to diversify your portfolio and generate a consistent movement of profits. Here are a few strategies for making an investment in constant profits:

- Bond Fund Investments: Bond finances are mutual funds that invest in a various portfolio of bonds. Those funds are controlled via expert fund managers who manage all aspects of bond investing, together with purchasing, promoting and analyzing the bonds.

- Bond Ladder strategy: This method entails shopping a series of bonds with staggered maturity dates. As every bond matures, the proceeds are reinvested in a new bond with the longest maturity date. This approach enables to mitigate hobby charge threat and affords a steady move of profits.

- Treasury Inflation-blanketed Securities (hints): those are bonds issued through america Treasury which can be listed to inflation. Because of this the most important and hobby bills boom with inflation, presenting a hedge against rising expenses.

- Company Bonds: those are bonds issued through businesses to elevate capital. They commonly offer higher yields than government bonds however also carry higher credit hazard.

- Municipal Bonds: those are bonds issued with the aid of nation and nearby governments to fund infrastructure initiatives. They offer tax advantages to traders because the hobby earned on municipal bonds is typically exempt from federal income tax.

Those are only some strategies for investing in fixed income. It’s important to do your studies and consult with a financial guide to decide the fine strategy to your funding wishes and goals.

Diversifying your constant income portfolio

Diversification is an crucial investment method and it’s also relevant on the subject of constant profits investments. Making an investment in quite a number constant income securities can assist to lower your investment risk and improve your possibilities of attaining your funding targets.

It’s crucial to take into account that constant profits investments are available in various bureaucracy which include company bonds, government bonds, municipal bonds, and others. Each type of bond has its own hazard level and varying hobby costs. Therefore, investing in a mix of those one-of-a-kind kinds of bonds can help to stability out your portfolio.

Any other component of diversification is timing. You have to consider impressive your investments over the years, instead of investing all of your cash without delay. This approach, referred to as greenback-fee averaging, enables you to buy greater stocks when the price of the investment is low, and less shares while the charge is excessive. Via spreading your investments over the years, you lessen the chance of buying all of your investments at a time whilst the market is high, and avoid the danger of dropping money if the marketplace drops.

Finally, it’s a very good concept to frequently evaluate your portfolio to make sure it stays different. Bonds can mature, and hobby costs can change, so it’s important to hold an eye in your investments and make adjustments in your portfolio while necessary. By diversifying your fixed earnings portfolio, you can reduce your threat and improve your possibilities of achieving your funding dreams.

Recommendations for a hit constant profits making an investment

Fixed earnings making an investment may be a first rate way to earn regular returns in your investments. Right here are a few recommendations that will help you succeed in fixed income making an investment:

- Diversify your portfolio – It’s crucial to diversify your portfolio by means of making an investment in a diffusion of constant profits securities, together with corporate bonds, municipal bonds, treasuries, and CDs. This can assist reduce your overall chance exposure.

- Recognize credit score rankings – credit score scores are an important factor in fixed income investing, as they decide the creditworthiness of the provider. Usually studies the credit score rating of an issuer before investing of their securities.

- Remember the yield to adulthood – The yield to maturity is the total go back anticipated on a bond if held until maturity. Usually consider the yield to adulthood whilst investing in fixed profits securities, because it will assist you decide the ability go back for your investment.

- Be aware of hobby price hazard – interest fee danger is the danger that the fee of a set profits protection will lower if interest costs upward thrust. Continually don’t forget interest rate hazard whilst investing in constant profits securities, and adjust your portfolio consequently.

- Make investments for the long-time period – constant earnings making an investment is generally a protracted-time period investment strategy. Don’t invest in constant earnings securities with the expectation of creating a short income. Instead, consciousness on making an investment for the lengthy-term to earn regular returns in your funding.

By means of following those pointers, you could come to be a a success constant income investor and earn consistent returns to your investments.

Conclusion and next steps for buying started out with constant earnings investing

In end, fixed profits investing is a first rate way to diversify your funding portfolio and reap financial balance. As a newbie, it’s vital to recognize the fundamentals of fixed profits investments, along with authorities and corporate bonds, and the various dangers involved, inclusive of interest charge hazard and credit score threat.

As soon as you have a terrific understanding of the fundamentals, the next step is to set your funding dreams and hazard tolerance. This will help you decide the type of bonds to spend money on and the length of your funding. You could then start constructing your portfolio with the aid of investing in person bonds or bond finances.

It’s important to keep in mind that constant earnings making an investment requires staying power and an extended-term outlook. You may now not see large returns within the short term, however over time, fixed earnings investments can offer regular income and make a contribution to your standard economic dreams.

To get began with constant profits investing, consider running with a monetary marketing consultant or dealer who permit you to navigate the marketplace and make informed funding selections that align together with your goals and threat tolerance.

Do not forget, making an investment in fixed income is just one a part of a properly-varied investment portfolio. It’s important to continue studying about one of a kind investment alternatives and regularly assessment and alter your portfolio to make certain it aligns with your monetary desires and needs.

We hope you enjoyed our amateur’s manual to making an investment in constant profits. We recognize that the world of making an investment may be intimidating and overwhelming, mainly in terms of fixed profits. But with the pointers and data supplied in this article, we are hoping that you are feeling confident in your capability to spend money on this area and start constructing your portfolio. Remember to continually do your due diligence and consult a monetary guide before making any funding decisions. Satisfied investing!